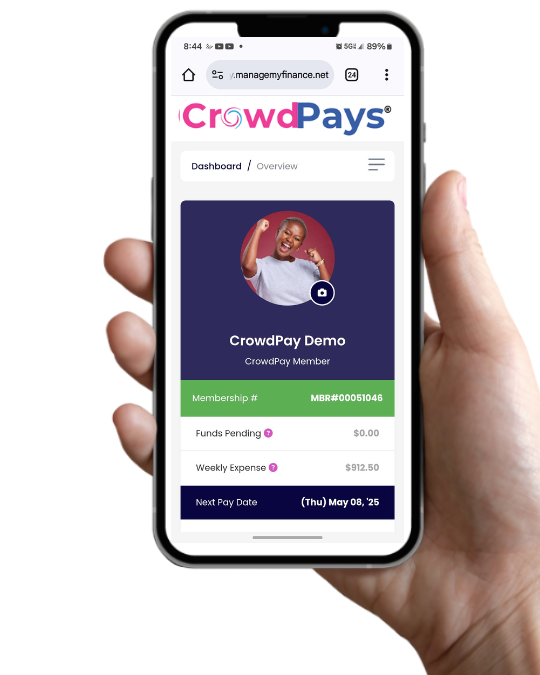

CrowdPay Inc., doing business as CrowdPays™, is a financial technology company (NAICS 522320) providing concierge-style automated bill payment through its proprietary SaaS platform, operating exclusively through regulated, FDIC®-insured banking and money-transmitter infrastructure. CrowdPays™ is not a bank.

CrowdPays™ operates exclusively as a bill pay concierge offering a Cash Back Rewards program. Members open user-named internal Expense Accounts used solely for paying verified, recurring household and personal bills such as rent, utilities, insurance, subscriptions, and other approved expenses. CrowdPays™ does not issue loans, advances, credit, or cash payments, and does not provide investment or financial advisory services.

Bill Pay Credits & Member Benefits

Cash Back Reward payments are not loans, advances, or credits against bills — they are earned membership rewards. Cash Back Reward payments are solely the result of participation in the bill pay club and may be reportable for tax purposes. Results vary by household.

If a client wants to point their Cash Back Rewards towards their expenses, CrowdPays™ may apply internal bill-pay credits toward a member’s verified expenses based on participation, deposit consistency, and platform eligibility criteria. These credits:

Over time, eligible members may receive substantial internal bill coverage applied directly to their household expenses. Results vary by household and participation level.

Not a Loan. Not Cash. No Repayment.

All CrowdPays™ credits and benefits:

-

are not loans, advances, or credit products

-

do not require repayment

-

do not accrue interest

-

are not reported to credit bureaus

-

do not result in personal debt

Members are responsible only for making scheduled deposits into the FDIC banking partner chosen by CrowdPays in weekly amounts sufficient to cover their bills after applicable internal credits are applied.

SuSu Reference (Modernized)

CrowdPays™ is sometimes described as a modernized “Bill Pay SuSu” because members coordinate bill payments through a shared system that uses scale and predictability to reduce how much each household must contribute.

Members do not receive cash from other members, do not participate in rotations, and do not depend on recruitment.

Compliance & Controls

CrowdPays™ complies with applicable KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. All deposits are member-initiated. CrowdPays™ does not initiate withdrawals from external member bank accounts and does not distribute funds directly to members.

Investment Disclaimer

CrowdPays™ does not offer investment advice, manage investment accounts, or act as a fiduciary. Any financial decisions made outside the CrowdPays™ platform are the sole responsibility of the member.

© 1994–2026 CrowdPay™ Inc. All rights reserved. CrowdPays™, Chippin In™, Bill Pay SuSu™, and related marks are trademarks of CrowdPay™ Inc.